BTC Price Prediction: Path to $200,000 Amid Technical Consolidation and Institutional Accumulation

#BTC

- Technical Positioning: BTC trades below key moving average with bearish MACD, suggesting near-term consolidation before major upward moves

- Institutional Accumulation: Continued corporate buying from MicroStrategy, CleanSpark, and Strive provides fundamental support for higher prices

- Regulatory Catalyst Potential: Trump's upcoming speech and SEC pressure on retirement accounts could provide volatility in either direction

BTC Price Prediction

BTC Technical Analysis: Key Levels to Watch

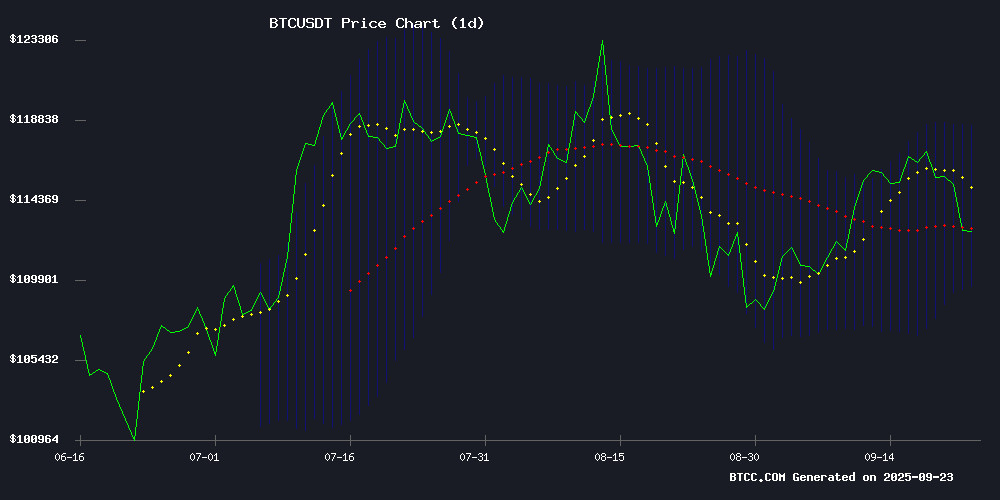

BTC is currently trading at $112,687, slightly below its 20-day moving average of $114,027, indicating near-term resistance. The MACD reading of -2,923 shows bearish momentum, though the narrowing histogram suggests potential stabilization. Bollinger Bands place immediate resistance at $118,533 with support at $109,521.

According to BTCC financial analyst William: 'The price action suggests consolidation around current levels. A break above the 20-day MA could trigger movement toward the upper Bollinger Band, while failure to hold $109,500 support may test lower levels.'

Market Sentiment: Regulatory and Institutional Developments

Recent news highlights mixed signals for Bitcoin. Positive institutional adoption continues with CleanSpark's $100M Bitcoin-backed facility and Strive's $675M treasury allocation, while regulatory uncertainty persists with SEC pressure on 401(k) accounts.

BTCC financial analyst William notes: 'The institutional accumulation trend remains strong, but traders should monitor Tuesday's Trump speech for political catalysts. The fundamental case for Bitcoin strengthens with each corporate adoption, though technicals currently dominate short-term price action.'

Factors Influencing BTC's Price

Bitcoin Analysts Pinpoint Key Levels for Price Support

Bitcoin has faced a significant downturn, prompting analysts to identify crucial support levels that could dictate its next moves. Swissblock Technologies highlights $112,000 as a pivotal threshold for stability, noting that maintaining this level could allow BTC to regain momentum. The firm's Risk Index, which incorporates on-chain valuation and cost-basis data, remains near zero—a signal of underlying bullish sentiment despite recent price declines.

Traders are also eyeing $110,000 as another critical support zone. Market participants must navigate volatility with precision, as these levels could determine whether Bitcoin consolidates or resumes its upward trajectory.

Bitcoin's Critical Support Levels Tested as Sell-Off Intensifies

Bitcoin's recent downturn has traders scrutinizing three pivotal price floors that could determine its near-term direction. Swissblock Technologies identifies $112,000 as the primary defense line, noting stability at this level could allow BTC to regain momentum. The firm's proprietary Risk Index—hovering near zero despite a 1.7% drop to $112,600—suggests underlying market optimism.

The $110,000 threshold emerges as a historical litmus test, having repeatedly challenged buyers during December-January cycles. Meanwhile, Glassnode's short-term holder cost basis metric at $111,400 serves as a psychological battleground, where sustained prices above this level typically signal bullish conviction.

Nine US Lawmakers Push for SEC Action on Crypto in 401(k) Retirement Accounts

Nine U.S. lawmakers are pressing the Securities and Exchange Commission to expedite regulatory updates that would allow cryptocurrencies in 401(k) retirement plans. The move follows President Trump's executive order aimed at broadening access to alternative assets.

A 1% allocation of 401(k) funds to digital assets could channel $93 billion into the crypto market. House Financial Services Committee leaders emphasize the need to modernize outdated restrictions preventing millions from diversifying retirement portfolios with Bitcoin and other cryptocurrencies.

The August 2025 executive order specifically targets democratizing investment options in retirement accounts. Lawmakers argue current regulations unfairly limit access to emerging asset classes that could provide portfolio diversification and growth opportunities.

CoreWeave's $9B Core Scientific Acquisition Faces Uncertainty Amid Stock Volatility

CoreWeave's ambitious $9 billion acquisition of Bitcoin miner-turned-AI infrastructure player Core Scientific shows signs of strain. CRWV shares initially plunged 30% post-announcement before recovering, while CORZ stock rode the acquisition premium to 45% gains—a divergence highlighting the deal's asymmetric risks.

The transaction's stock-based structure magnifies exposure to CoreWeave's volatility, leaving CORZ shareholders particularly vulnerable to downside. Both companies exemplify the crypto mining sector's pivot to AI infrastructure, with Core Scientific recently emerging from bankruptcy to repurpose mining facilities for data center operations.

CleanSpark Secures $100M Bitcoin-Backed Credit Facility from Coinbase Prime

CleanSpark (CLSK) shares surged nearly 6% in post-market trading after announcing a $100 million credit facility backed by Bitcoin holdings. The deal with Coinbase Prime allows the miner to avoid equity dilution or BTC sales while funding expansion plans.

The capital will target strategic initiatives including mining infrastructure growth, energy portfolio diversification, and high-performance computing (HPC) investments. "Our 'Infrastructure First' strategy enhances shareholder value through non-dilutive financing," said CFO Gary Vecchiarelli, signaling a shift toward diversified compute opportunities beyond Bitcoin mining.

The move reflects an industry trend of miners leveraging Bitcoin as collateral to fund operations while retaining exposure to potential price appreciation. CleanSpark's leadership changes had previously hinted at ambitions beyond pure-play mining operations.

Bakkt Stock Surges 40% After Adding Crypto Veteran Mike Alfred to Board

Bakkt Holdings (BKKT) shares jumped over 40% following the appointment of digital assets expert Mike Alfred to its board. The market reaction underscores investor confidence in Alfred's ability to steer Bakkt's institutional fintech strategy.

Alfred brings deep crypto pedigree from his tenure at Digital Assets Data (acquired by NYDIG) and leadership at Bitcoin-focused Alpine Fox LP. His network and governance expertise position Bakkt to capitalize on blockchain adoption trends.

The move signals Bakkt's ambition to strengthen its position in institutional digital asset infrastructure. CEO Akshay Nahta highlighted Alfred's proven track record in scaling fintech ventures as critical for Bakkt's next growth phase.

President Donald Trump Set for Major Speech on Tuesday; Is It Bitcoin’s Big Political Day?

Bitcoin traders brace for a potential watershed moment as U.S. President Donald Trump prepares to deliver a major speech on September 22, 2025. The crypto market remains on high alert following Monday's $1.7 billion leveraged trade liquidation—the largest year-to-date wipeout—amid growing regulatory anticipation.

The Satoshi Action Fund, led by Dennis Porter, has intensified its Washington D.C. lobbying efforts, teasing a "defining moment" for Bitcoin's political trajectory. Market sentiment remains fragile, with the Crypto Fear & Greed Index hovering below 50% for consecutive days.

Speculation mounts over whether the White House will address Bitcoin reserves or regulatory frameworks. This development follows months of escalating institutional interest and could cement cryptocurrency's role in the 2025 political agenda.

MicroStrategy's Bitcoin Bet Grows Amid Stock Dip

MicroStrategy Inc. (MSTR) shares fell 2.49% to $336.17 despite the company's latest Bitcoin acquisition. The enterprise software firm purchased 850 BTC for $99.7 million between September 15-21, bringing its total holdings to 639,835 bitcoins worth approximately $72 billion at current prices.

The company's aggressive accumulation strategy continues through creative financing. MicroStrategy funded this purchase via at-the-market equity offerings of Class A common stock, maintaining its relentless pursuit of Bitcoin exposure. Its '42/42' plan aims to grow reserves to $84 billion by 2027.

With 3% of Bitcoin's total capped supply now in MicroStrategy's treasury, the firm's unrealized gains exceed $25 billion. Market observers note the paradoxical relationship between MSTR's stock performance and its growing crypto war chest—a dynamic that continues to draw both admiration and skepticism on Wall Street.

Why Is Bitcoin Down Today, September 22, 2025?

Bitcoin's price decline to $112,537.66 reflects heightened market uncertainty despite recent Federal Reserve rate cuts. Liquidation of long positions has accelerated downward momentum, particularly after BTC breached critical support at $115,000.

Traders remain cautious ahead of upcoming PCE inflation data, with technical indicators turning bearish. The $117,000-$118,000 resistance zone continues to cap rallies, while $112,000 emerges as a crucial support level. A break below could test $110,000.

Market sentiment must stabilize above $114,500 for any meaningful recovery attempt. The Fed's ambiguous policy trajectory and broken technical levels have temporarily overshadowed Bitcoin's fundamental strengths.

Strive Amplifies Bitcoin Bet with $675M Treasury Buy and Semler Merger

Strive, Inc. has executed a dual-track strategy to cement its position as a leader in Bitcoin-centric corporate growth. The firm finalized an all-stock acquisition of Semler Scientific, Inc., while simultaneously adding $675 million worth of Bitcoin to its treasury. This aggressive accumulation brings Strive's total BTC holdings to 5,886 coins.

The merger terms reveal a 210% premium for Semler shareholders, with each share converting to 21.05 Strive Class A shares. Eric Semler will join Strive's board as the combined entity pursues growth in both healthcare diagnostics and digital asset strategies. The company maintains flexibility to potentially monetize or spin off the diagnostics business in future.

This move signals growing institutional confidence in Bitcoin as a treasury asset, with Strive now holding over 10,900 BTC across its corporate structure. The transaction creates a unique hybrid entity blending traditional healthcare operations with cryptocurrency-focused financial strategy.

Michael Saylor Expands Bitcoin Holdings with Strategic $99.7M Purchase

MicroStrategy's executive chairman Michael Saylor continues to reinforce his position as Bitcoin's most vocal institutional advocate. The business intelligence firm added 850 BTC this week at an average price of $117,344 per coin, bringing its total holdings to 639,835 BTC. This latest $99.7 million acquisition follows Saylor's unwavering accumulation strategy through both bull and bear markets.

The company's total Bitcoin treasury now carries an average cost basis of $73,971 per coin, demonstrating the advantage of persistent accumulation. September's purchases totaled 1,428 BTC—the slowest monthly pace since May—but with potential for additional acquisitions before month-end. The past twelve months saw record purchases of 4,930 BTC following key macroeconomic developments.

MicroStrategy's approach has become a case study in corporate Bitcoin strategy, contrasting with the growing popularity of spot Bitcoin ETFs. While the article mentions reserve companies and ETFs paving alternative paths, Saylor's direct acquisition model continues to deliver substantial unrealized gains for shareholders.

Will BTC Price Hit 200000?

Based on current technical and fundamental analysis, reaching $200,000 requires significant catalysts. The current price of $112,687 represents a 77% increase needed to achieve this target.

| Metric | Current Value | Required for $200K |

|---|---|---|

| Price | $112,687 | +77% |

| 20-day MA Position | 1.2% below | Sustained break above |

| MACD Trend | Bearish | Bullish crossover needed |

| Key Resistance | $118,533 | Multiple breakouts |

BTCC financial analyst William comments: 'While $200,000 is achievable in the medium term, it requires either rapid institutional adoption acceleration or major regulatory clarity. Current technical setup suggests consolidation first, with potential breakout later in 2025 if institutional flows persist at current rates.'